Is GST still a headache for your business ?

Why to struggle with ever changing GST laws when we are here to take care of it for you.

We offer Online GST Registration and filing of GST returns for Businesses established at any place in India.

Reach Us

Following Documents required for GST registration and we can also help you to prepare these documents.

Sole proprietor/ Individual

– Pan Card (owner)

– Aadhar Card

– Photograph (in JPEG format)

– Bank account details (a copy of cancelled cheque or extract of bank statement or passbook must be uploaded in JPEG or PDF format

– Address proof (any of the following is acceptable as address proof- ownership or lease document, electricity bill copy, property tax receipt, municipal khata copy).

– In case it is a leased property, a consent letter or NOC from the owner is required.”

Partnership firm including LLP

“- PAN card of all partners

– Copy of partnership deed

– Photographs of all partners and other authorised signatories

– Address proof of partners

– Proof of appointment of authorised signatory

– Aadhar card of authorised signatory

– In case of LLP, a registration certificate is required

– Address proof of place of business

– In case it is a leased property, a consent letter or NOC from the owner is required.”

HUF

“- PAN card of HUF

– PAN and Aadhar card of karta

– Photograph of owner

– Bank account details

– Address proof of place of business

Company (public and private) (Indian and foreign)

“- PAN card of company

– Incorporation certificate

– PAN and Aadhar of authorised signatory (authorised signatory has to be Indian)

– Proof of appointment of authorised signatory

– PAN and address proof of all the directors

– Photographs of all directors and authorised signatory

– Bank account details

– Address proof of principal place of business

Benefits of GST registrations.

Legal Identity – GST registration lends credibility to your business and signifies that you are operating within the legal framework. It helps in building trust with customers and suppliers.

Wider Market Reach: GST is a nationwide tax system, and registration enables you to do business seamlessly across state borders without worrying about different state taxes. This expands your market reach.

Input Tax Credit (ITC): Registered businesses can claim input tax credit on the GST they pay on their purchases. This means reducing the overall tax liability.

Competitive Advantage: You can have a competitive edge over unregistered business as it allows you to offer lower prices by passing on the benefits of ITC to customers.

Eligible to sale on E-commerce Platforms: Many e-commerce platforms and marketplaces (eg. Flipkart / Amazone) require GST registration for sellers. This opens up opportunities for online sales and reaching a broader customer base.

B2B business opportunity : Many larger businesses prefer to work with GST-registered suppliers as it ensures they can avail of input tax credit. This can lead to more B2B opportunities for your small business.

Easy Filing and Compliance: The GST portal provides a straightforward mechanism for filing returns and paying taxes. The digital platform simplifies the compliance process, reducing the burden of paperwork.

Government Tenders: GST registration is often a prerequisite for participating in government tenders and contracts.

Avoid Penalties: Non-registration or non-compliance with GST rules can lead to penalties and legal consequences. Registration helps you avoid these issues.

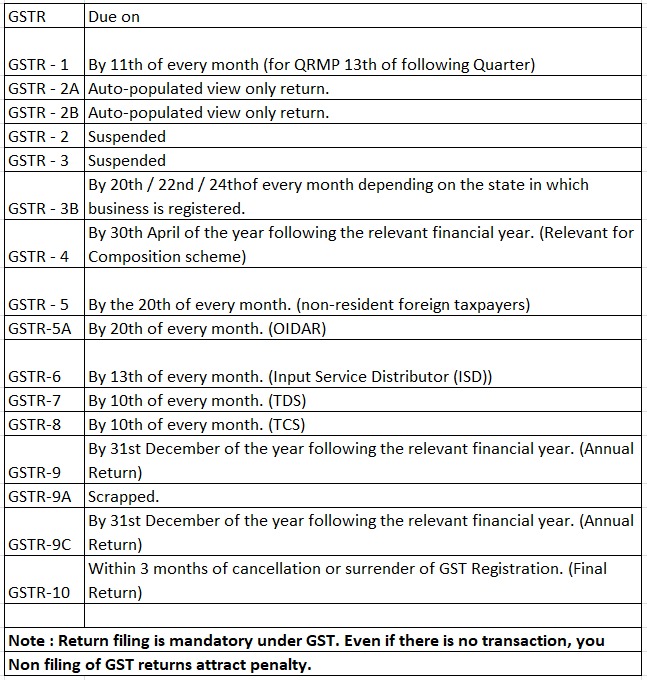

GST Returns There are 22 types of GST returns but you don’t have to worry about it as Thetaxseva.com is here to make you burden free from filing GSTRs on time and with accuracy.

Type of GSTR and their due dates :